Latest jobs

Latest jobs

Corporate Development Manager

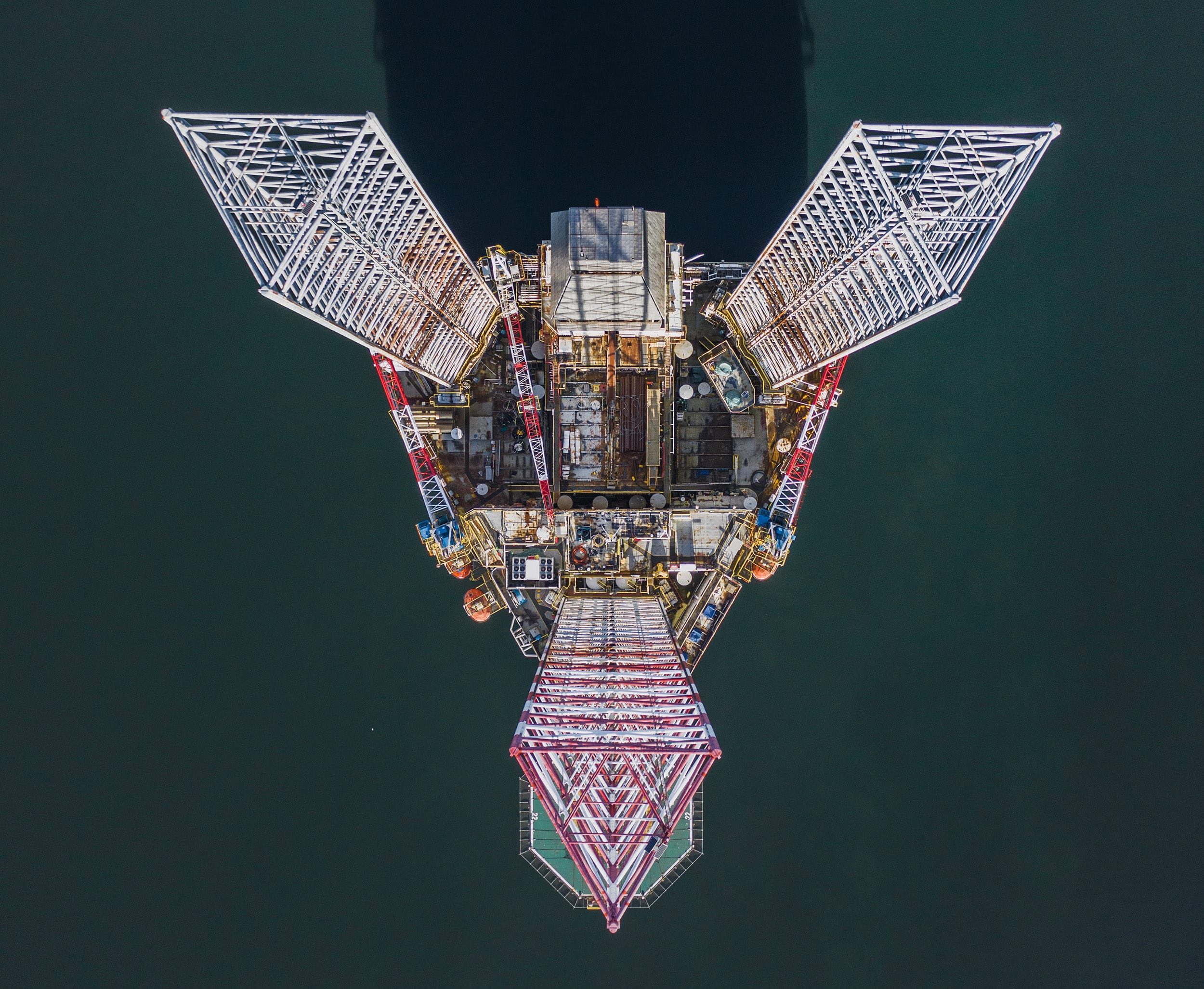

Viaro Energy is an independent British energy company run by a team with over six decades of combined experience in the industry. Through our main subsidiary RockRose Energy, Viaro operates in the North Sea and has interests in over 30 fields within the UKCS and the Netherlands. We are committed to supporting the long-term energy security of the UK and our assets account for 9% of daily gas production.

Reporting to the Chief Operating Officer, the Corporate Development Manager will play a central role in shaping the company’s strategic and commercial direction. The Corporate Development Manager is responsible for creating value and reducing commercial risk across the company’s upstream and midstream portfolio. This senior role has accountability for M&A, operated and non-operated assets, sales arrangements and stakeholder engagement. The position provides commercial governance, oversees negotiations and ensures matters escalated are resolved in the best interests of the company. The role requires a blend of strategic vision, financial expertise and strong negotiation skills to deliver long term value aligned with corporate strategy and delivery of business objectives.

Strategic Value Creation & Opportunity Development

- Lead the identification, evaluation, and execution of strategic growth initiatives, including mergers and acquisitions (M&A), farm-ins/farm-outs, joint ventures, and divestitures to enhance corporate value and mitigate commercial risk. All in line with corporate strategic objectives, from initial screening to completion, including corporate acquisition targets.

- Build and maintain a strategic, value adding and robust pipeline of investment opportunities, informed by proactive market intelligence, industry engagement, and a strong understanding of corporate strategy.

- Provide strategic insights to position the company competitively and assist in the preparation and delivery of strategic reviews and presentations; including board papers.

- Oversee the development of robust financial models, including valuation, sensitivity analyses, and risk assessments, to support decision-making and board-level presentations. Preparing clear, actionable investment memos and communicate recommendations effectively to senior leadership.

- Lead negotiations on deal structures and terms that maximise returns and mitigates risks.

- Ensure alignment of transactions with long-term strategy and risk appetite.

- Provide direction and decision making authority on matters escalated by commercial advisors.

- Identify and evaluate opportunities across operated and non-operated portfolios.

- Develop and maintain close relationships with key external stakeholders in other upstream, midstream companies, investment banks and advisors.

- On an as needed basis, support the team with Investor Relations activities including corporate presentations and investor roadshows etc.

Non-Operated Asset Management

- Provide commercial governance over partner-operated assets through OCMs and TCMs.

- Evaluate the commercial viability of non-operated exploration and development projects, incorporating technical, operational, financial, and strategic analyses.

- Monitor and influence partner-operated assets to align with company objectives.

- Represent company interests in joint venture committees and negotiations where appropriate.

- Ensure partner decisions support value creation and limit exposure.

- Review, challenge and approve recommendations from Commercial Team.

Operated Assets Management

- Lead the development and implementation of commercial strategies for operated assets to maximise value and mitigate risk. Working cross-functionally with operational teams, finance, and partners to deliver value-driven solutions that align with asset objectives and long-term viability.

- Support asset teams in framing, negotiating, and executing business plans aligned with corporate objectives.

- Act as the primary commercial interface with joint venture partners, government bodies and regulators. Take an active role in cross-operator forums and government-industry initiatives, particularly around late-life asset strategy.

- Ensure compliance with all commercial agreements and government obligations.

- Oversee and in some cases, lead the negotiation and execution of key commercial agreements including Sales and Purchase agreements, Transportation agreements, Decommissioning Security Agreements, Unitisation Agreements Proximity Agreements etc ensuring commercial terms are competitive, risk-managed, and aligned with company interests. Collaborating closely with Legal, Finance, and Tax teams to ensure contracts are legally sound and fiscally efficient.

- Track macroeconomic trends, energy market dynamics, and regulatory developments to inform strategic decision-making and corporate positioning. Advising executive management on emerging risks and opportunities, particularly relating to commodity pricing, policy shifts, and sector-wide changes.

- Engage regularly with joint venture partners to secure alignment on operational and financial plans. Supporting field operations and finance with commercial insight on cost optimisation and revenue enhancement opportunities. Analyse market conditions and production performance to guide asset and investment decisions.

- Lead and develop a high-performing commercial team, ensuring clear alignment with business priorities. Providing mentorship, coaching, and career development support, fostering a culture of accountability, quality, and continuous improvement. Oversee workload prioritisation to balance strategic initiatives with daily commercial support and ensure adherence to internal systems and policies. Promoting collaborative, cross-disciplinary working practices to deliver integrated commercial solutions.

Sales and Crude Marketing

- Oversee the marketing and sales strategy for crude oil and liquids from operated assets.

- Oversee crude sales agreements, lifting programs, nominations and scheduling to ensure timely delivery and optimal pricing.

- Interface with trading, shipping and refining counterparts to capture market opportunities and mitigate exposure.

- Monitor market trends, pricing benchmarks and regional supply-demand dynamics to optimize realization value.

- Ensure transparent reporting and compliance with regulatory requirements for hydrocarbon sales.

Education level

- Degree in a relevant discipline (e.g., Business, Economics, Law, Engineering).MBA or advanced degree preferred.

Experience

- A strong commercial orientated background with a minimum of 15 years’ oil and gas industry experience with either a major or independent oil and gas company, preferably, with midstream experience.

- Investing banking and international experience advantageous.

- Ability to undertake economic and financial modelling analyses in varying fiscal environments, including both Tax & Royalty and PSC contracts.

- Strong track record in contract negotiation, joint venture management and government relations.

- Extensive understanding of the UK oil and gas industry including its license and regulatory regime, with well established relationships within the regulator and sector to support the identification of opportunities, risks and mitigations.

Specific skills

- Strategic thinker with strong analytical and business acumen.

- Proactive problem solver.

- Exceptional productivity skills willing to work in a fast paced environment

- Excellent interpersonal and influencing skills across multi-disciplinary teams.

- Ability to navigate complex JV and regulatory environments under time and commercial pressure.

- Strong written and verbal communication skills.

- Proactive and solution-oriented.

- Ability to handle and protect sensitive information in a confidential and professional manner.

– Competitive salary and benefits package

– Opportunities for professional growth and development

– A dynamic and supportive work environment

Interested candidates should submit their applications via the apply button below with your CV and a cover letter outlining your suitability for the role. Please include the job title in the subject line.

Viaro is an equal opportunity employer. We celebrate diversity and are committed to creating an inclusive environment for all employees.

CAREERS

For any information regarding career opportunities at Viaro Energy,

or to submit your application, please fill out the form below.

Latest jobs

Latest jobs